how to lower property taxes in nj

Rasmussen said the average New Jersey renter who pays. New Jerseys real property tax is an ad valorem tax or a tax according to value.

5 More Ways To Reduce Property Taxes In Nj Egea

New Jersey voters tried unsuccessfully in 1981 in.

. 250 veteran property tax deduction. Can you write off property taxes in NJ. General Property Tax Information.

Are NJ taxes higher than NY. Here are five interventions to cut spending and reduce property taxes. How can I lower my property taxes in NJ.

NJ has certain programs that can help you reduce your property taxes. In 2020 some counties appeal deadline was April 1 while in otherssuch as Monmouth and Gloucester countiesit. Here are the programs that can.

New Jersey offers different tax relief programs not only typical exemptions but also deductions of 250 and deferments or postponements of tax payments. While both New York and New Jersey have relatively high income taxes New Jerseys lowest income tax rate is 14 percent while New Yorks is 4. A New Jersey real estate property owner and sometimes a tenant has the legal right to attempt to reduce their real estate taxes through the.

I definitely agree that there is an influx of families an retirees relocating out of state due to the high property taxes. Go to the New Jersey Division of Taxation website through the link in the References section. Plus since there are several ways your appeal can get thrown out and lots of heady math involved a tax attorney can help you figure out whether you have a caseand help.

The Real Property Tax Appeal. The measure would change the deduction for rent payments considered as property taxes from 18 to 30. Find the three tax ratios for your city.

Property Tax Deduction Qualified homeowners and tenants are eligible for a deduction for property taxes they paid for the. Average Property Tax Rate. If you were in the program prior to the move and received a reimbursement for the last full tax year you occupied your previous home you may qualify for the 2-year exception.

How Can New Jersey Lower Property Taxes. 250 deduction for veterans. Property tax exemptions for people with disabilities are.

Give power back to the people of New Jersey. Here are the programs that can help you lower property taxes in NJ. Currently NJ has the highest property taxes in the States.

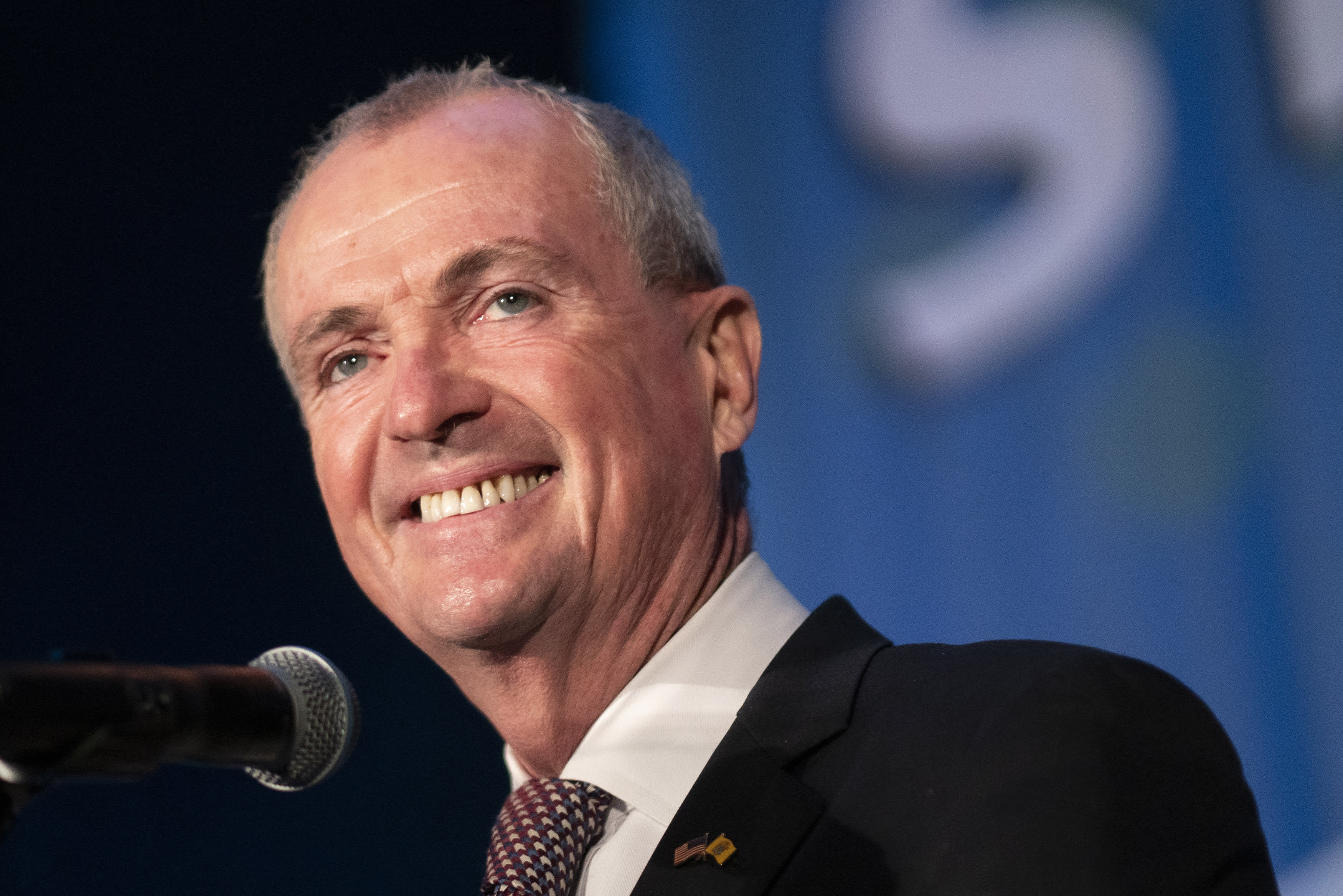

It was announced earlier today that Murphy will propose 1 trillion dollars in relief to the taxation of property. Click on your county. The assessment calendar is not the same in every county in New Jersey.

All real property is assessed according to the same standard. We present you with a list of the towns with the lowest property tax rate in New Jersey belowcheck it out.

New Jersey 2021 Property Tax Rates And Average Tax Bills For All Counties And Towns

How Do State And Local Property Taxes Work Tax Policy Center

New Jersey Has Nation S Highest Real Estate Property Tax Study Raritan Bay Nj News Tapinto

How To Lower Your Property Taxes Wsj

New Jersey Governor Floats Property Tax Relief For Homeowners Renters

Gottheimer Announces 108 Increase In Federal Tax Dollars Clawed Back To Nj 5 Since 2016 To Help Lower Property Taxes Claw Dollars Back From Moocher States U S Representative Josh Gottheimer

Once Again Study Says New Jersey Has Country S Highest Property Taxes Jersey Digs

Nj Property Taxes Have Been Rising At A Slower Pace Nj Spotlight News

Tax Collector Millburn Township Nj Official Website

Solved Remove These Wages I Work In New York Ny And Live In New Jersey Nj

Murphy Claimed He S Done The Most For Nj Property Taxes Is It True

U S Property Taxes Comparing Residential And Commercial Rates Across States

Tax Collector S Office Manville Borough Nj Official Website

Nj Anchor Rebate Information Coming Soon To Your Mailbox

Nj Property Tax Relief Program Updates Access Wealth

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

New Jersey Is 2021 S State With The 7th Highest Tax Burden Study Scotch Plains Fanwood Nj News Tapinto

Top Property Tax Increases Decreases In Every Nj County Last Year